Hello Investor / Advisor !

Get the best portfolio analysis online with Risk Score and benchmark from your fellow investors alongside AI market trends insights.

Many investors and advisors have no idea about their portfolio risk, don’t be one of them

Check how much of your investment is at risk now !

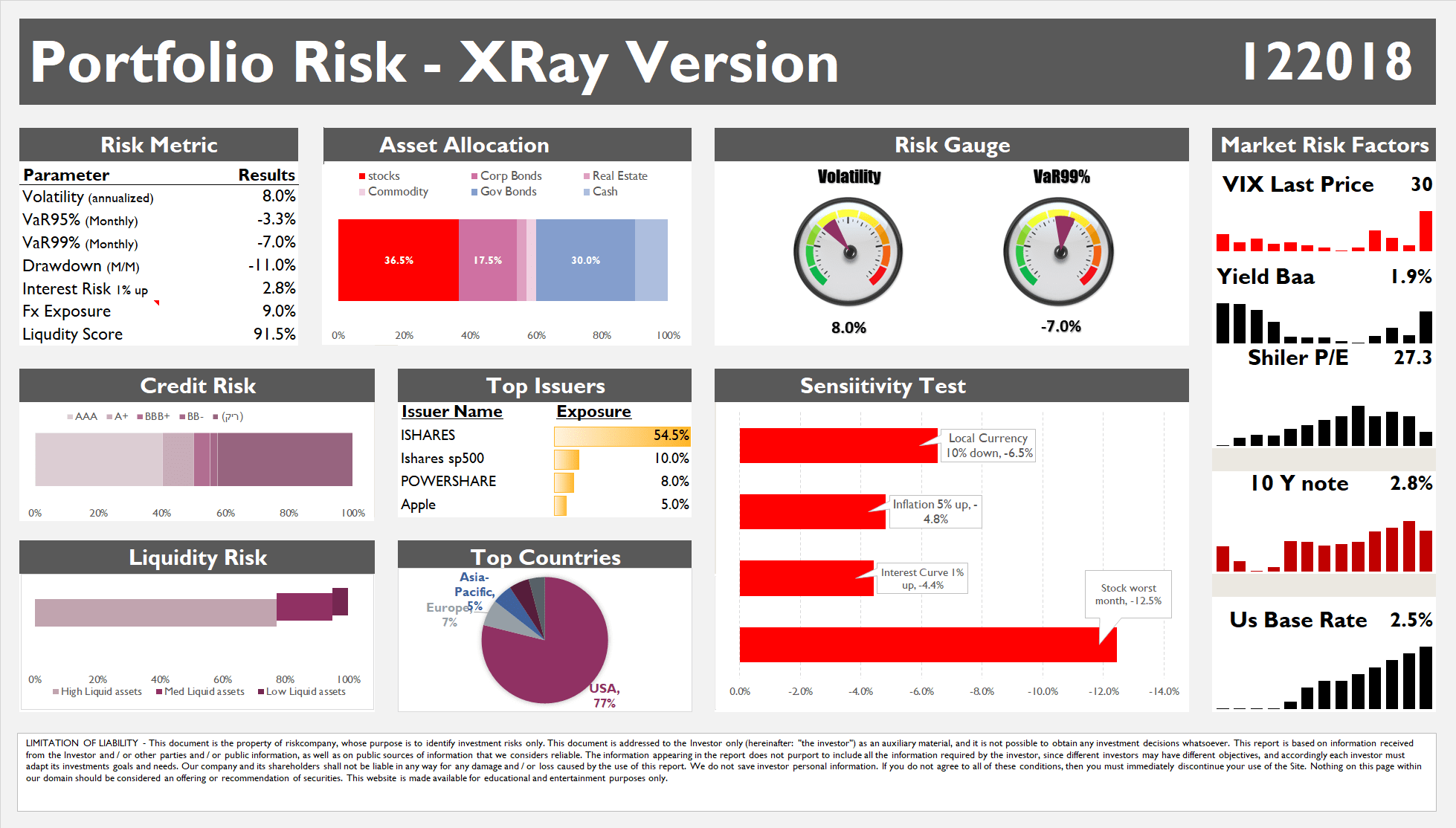

X-Ray (Basic Coverage)

X-Ray is a basic snapshot of the investment portfolio. Investors will get a basic idea about its portfolio major risks like Market ,Credit, Diversification and also Liquidity at a glance.

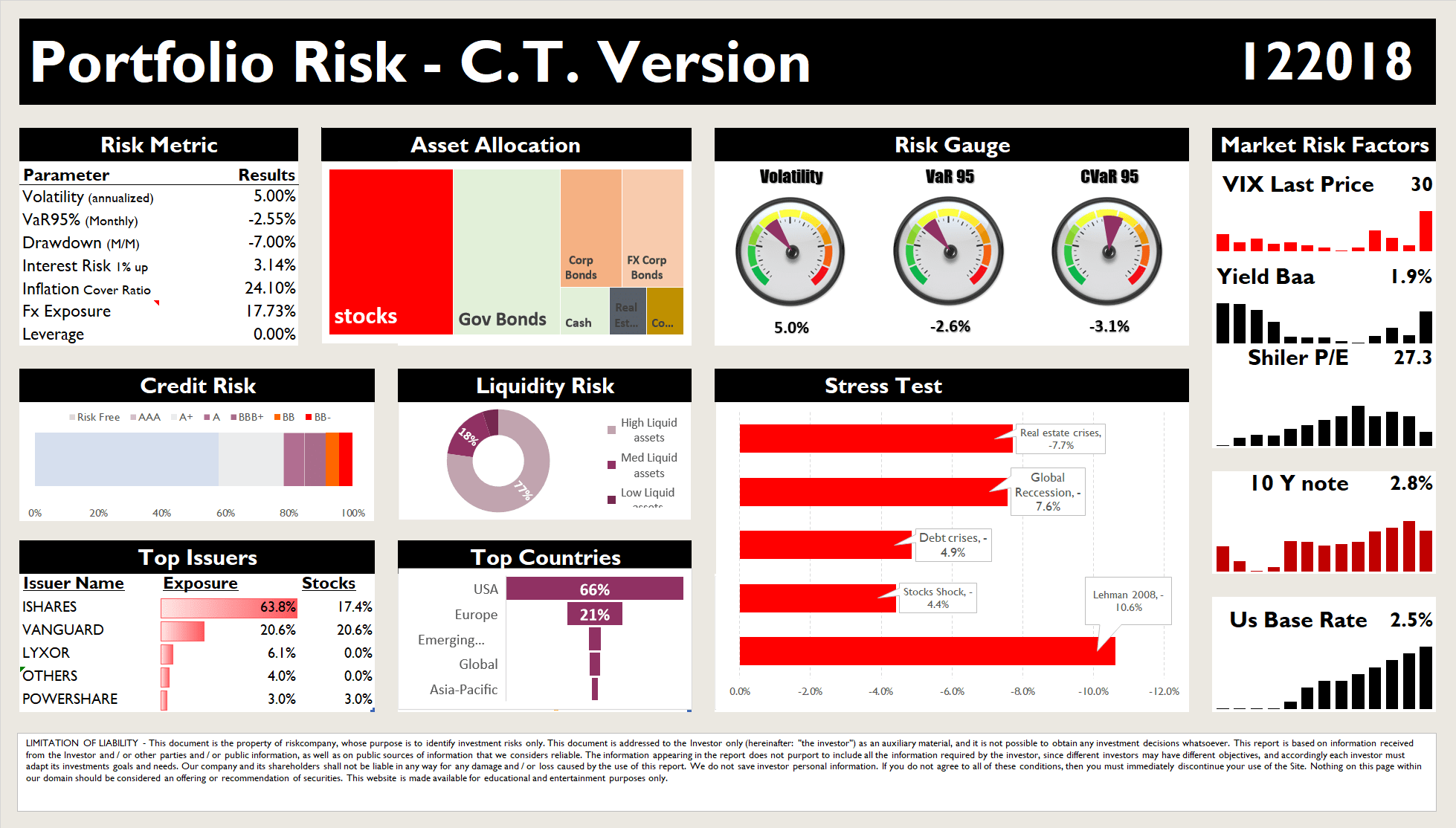

C.T. (Standard Coverage)

C.T. is a standard yet comprehensive advanced report of the investment portfolio. Investor will get a true risks of its portfolio like Market ,Credit, Liquidity and Diversification include what if scenario and historical max drawdown.

MRI (Premium Coverage)

MRI is a comprehensive & powerful tool to analyze complex and even leverage portfolios. the report include performance checkup using our Artificial Intelligence system. In this report we can handle non traded and non linear assets. Investors can request tailor made report to their special needs and we can also offer portfolio optimization using our machine learning methods. Launching soon

Our mission is to unveil, spotlight and quantify the major risks of your portfolio instantly, at high quality and at low price.

Whether you want to check your portfolio risk or shifting to a new investment model, we spotlight the portfolio main exposures and risks using AI technology and therefore assists you to determine if the proper risk appetite suit your needs. we add some Stress testing For the same reason that every car automaker do it, to protect you (your money) and help you understand what will be the result in case of a what if scenario occur.

Remember its better to understand what if (scenario) before it becomes what happen scenario.

How it works – very simple just a few clicks

Create an account

Upload your portfolio

Get your risk report

A word from industry expert on risk

“Some events can be rare and consequential ,but somewhat predictable, particularly to those who are prepared for them and have the tools to understand them (instead of listening to statisticians, economists, and charlatans of the bell-curve variety)”.

“Much of the real world is controlled as much by the “tails” of distribution as by the mean or averages; by the exceptional, not by the mean; by the catastrophe, not the steady drip… We need to free ourselves from ‘average’ thinking”

“Compound returns, not average returns or performance relative to a benchmark, should be our major focus. They are enhanced most by mitigation of tail losses and participation in tail gains, each period of time. The options market prices provide valuable information about the risk of each period’s gain and losses.”

Get your portfolio risk analysis

Creat your account, upload a portfolio and get your risk analysis